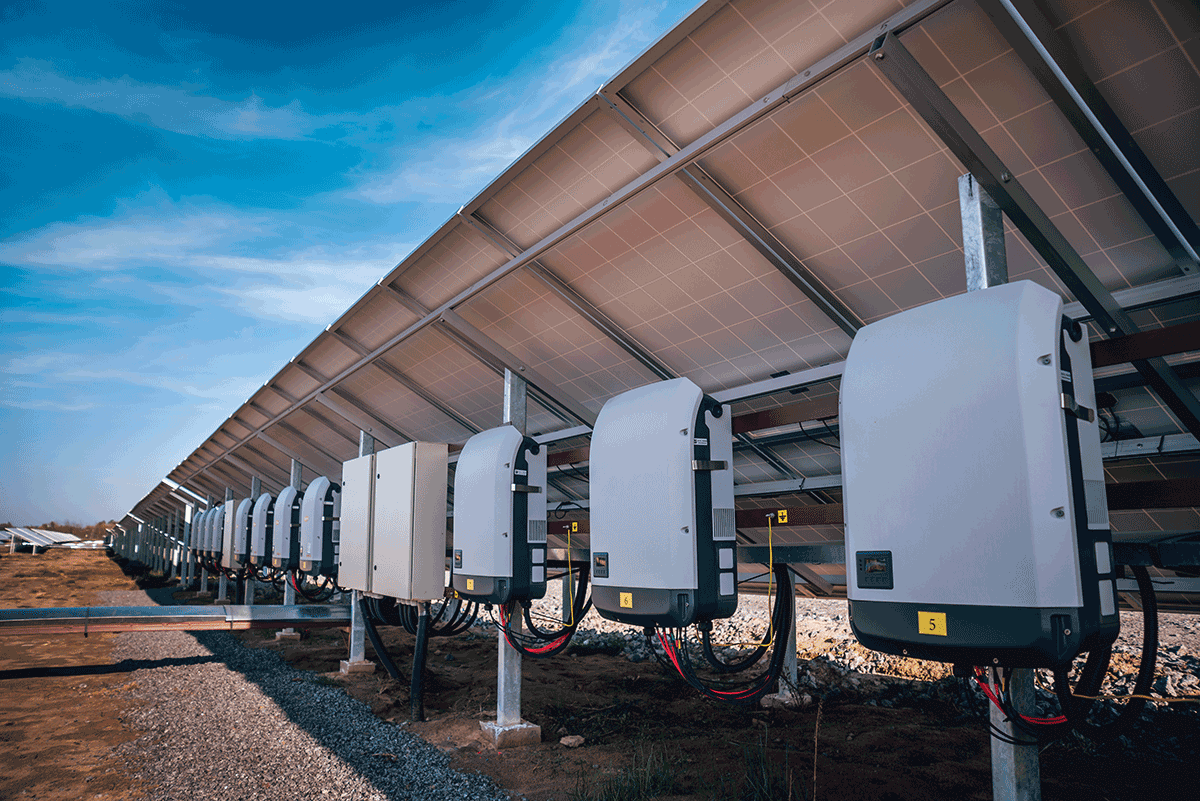

For more than a century, the North American electrical grid has operated on the same model: large power sources generate power and channel it into a web of transmission lines and local distribution areas (LDAs), never to return to the point of origin. That model is changing as the market shifts to newer, cleaner energy sources like wind and solar. Today, we need new systems for energy management, including energy storage.

Just like your mobile phones and electric vehicles (EVs), a clean-energy grid depends on batteries to function. When the sun goes down or the wind isn’t blowing, they must include storage to keep power flowing. With the race against the clock (known as climate change) officially running, we need to invest heavily in multiple technologies that will reduce our energy and carbon footprints.

Choices, choices, choices

To develop effective energy storage systems, the electrical community must become well versed on these different types of storage and understand what applications drive the most efficiency on the grid. Take a look at the three most popular technologies that generated the most power capacity out of all new projects announced from 2016 to 2017.

Lithium-ion batteries (80.2 percent of new project power capacity). In terms of round-trip efficiency, lithium-ion (Li-ion) batteries stand among the elite. These batteries boast a small physical footprint thanks to their energy density, making them a smart choice for urban centers, islands, and other space-sensitive locations. Li-ion batteries are also getting more affordable by the year. Estimates show that from 2014 to 2017, the price of bulk Li-ion storage systems dropped 48 percent, as they have become increasingly used in stationary energy storage and electric vehicles. However, the most critical factor in the battery’s success is the financial power behind leading vendors like Tesla, Panasonic, and Samsung. For the past decade, Li-ion batteries have excelled in consumer electronics, and are now scaling to grid functions.

Li-ion batteries work by utilizing the flow of lithium-ions between a cathode and anode, with the cathode usually comprising either a layered oxide, a polyanion (such as a lithium-iron phosphate), or a spinel (such as lithium-magnesium oxide). The anode is often graphite separated from the cathode by a liquid or solid electrolyte.

Since Li-ion batteries have excellent energy and power densities, round-trip efficiency and lifecycle values, they are adept at power-intensive grid applications, especially for utility-scale energy storage applications. Their ability to be mass-produced is also attractive for large, utility electrical installations. However, Li-ion batteries require complex thermal management because they contain a flammable electrolyte. As a result, Li-ion batteries often require complex safety features.

Flow batteries (8.9 percent of new project power capacity). Flow batteries are another growing energy storage option. Generally defined as single-cell batteries that transform electron flow into electric current, they charge and discharge power by pumping a liquid anolyte and catholyte across a membrane. The spent electrolyte can then be recharged from external sources and used repeatedly. There are three chemistry options with flow batteries: zinc bromine, vanadium redox, and iron chromium.

These batteries can store energy for lengthy periods of time, making them a strong choice for long-duration and low-cost operations that involve shifting hours’ worth of energy generation from one time of day to another. Additionally, flow batteries do not require thermal management, making them notably safer. Since flow batteries have little to no depletion of active materials over time, their lifecycle expectations are superb. This quality is reinforced by the fact that many flow batteries use inexpensive materials, with the exception of vanadium.

While there are many advantages to this storage option, flow batteries are not appropriate for every instance of energy storage. Because replacing the ion exchange membrane can become expensive, flow batteries are not a suitable selection for short-duration applications, such as frequency regulation. In such scenarios, flow batteries struggle to compete with Li-ion-based solutions.

Compressed air energy storage (CAES) (6.9 percent of 2016–2017 new project power capacity). CAES systems are suited for long-duration, energy-intensive grid services, such as spinning reserves. CAES technology resembles pumped hydro systems but stores ambient air under high-pressure conditions and then heats that air while passing it through a generator-tied turbine. This form of storage often uses natural gas, but only about 33 percent as much gas as a normal turbine would need.

A CAES system is most useful for large-scale energy storage deployments typically ranging between 50–300 MW. They can be brought to full load in about 10 minutes. CAES systems offer flexible cycling options to provide grid balance, allowing utilities to optimize baseload units by minimizing load swings, increasing efficiency and life expectancy.

When considering utility-scale storage options and installations, CAES systems can handle large tasks and are not limited to geological conditions. Work must still be done to implement CAES commercially, but the next generation looks promising.

What about pumped hydro storage?

While pumped hydro is a popular energy storage system, with 161 GW worth of capacity in operation worldwide, it cannot expand enough to meet the energy storage needs of the future.

For hydro to function, it first needs two proximal, large reservoirs with enough water surface and pressure elevations between them. Hydro also needs suitable geological formations, which themselves tend to be rare and in remote locations, such as high in the mountains where construction may be difficult and expensive. The result is an extensive, complex, and financially intensive development process.

As a result, pumped hydro cannot be readily expanded to keep pace with energy storage demand.

Moving the energy storage needle through supportive policy

As we transition to a more environmentally friendly energy platform, battery and energy storage will become a great necessity with a variety of options to select. But in addition to good intentions, what exactly is pushing energy storage forward?

Excluding pumped hydro, North America is currently the largest global market for installed energy storage projects thanks largely to supportive policies at the state and federal levels. Mandates directing local utilities to deploy energy storage systems have spurred market growth in the industry and in the states themselves.

The energy storage wave started rolling in 2013 with the first—and still one of the most impactful—mandates, AB 2514, which required California’s largest investor-owned utilities to deploy a total of 1,325 MW of energy storage by 2020. The California Public Utilities Commissions issued a further order in 2017, requiring utilities to procure an additional 500 MW of behind-the-meter power for distribution grid-connected energy storage.

In Oregon, a small mandate requiring 5 MWh of capacity by 2020 led to Portland General Electric announcing their intention to deploy 39 MW of energy storage. New state-level mandates requiring utilities to compare the cost/benefit ratio of storage alongside other infrastructure improvements like power lines, substations, and generation capacity have also helped normalize investment in energy storage, a developing trend in New Mexico, Colorado, Washington, Arizona, and Oregon.

Action at the federal level is also playing a role in the expansion of energy storage, but at a much slower pace. The Federal Regulatory Commission’s (FERC) Order 841 seeks to “remove barriers to the participation of electric storage resources in the capacity, energy, and ancillary service markets.” However, while FERC has a wide jurisdiction over the electricity supply, the majority of the U.S. regulations don’t consider the attributes of energy storage, and in some cases, they’re forbidden from providing certain services. The support of the electrical community is needed in the coming years to help normalize such technology and push for policies that advance energy storage.

Plummeting costs meet skyrocketing rewards

The energy storage market has achieved tremendous growth thanks to rapidly decreasing prices for battery technologies over the past two years. This has allowed developers to offer consistently lower prices, especially for systems integrating with large-scale solar photovoltaic plants. For example, in 2016 Tesla made national news when it signed with Kauai Island Utility Cooperative in Hawaii to sell energy from a solar-plus-storage plant for 13.9 cents per kWh. It didn’t even take a year for that to be outdone by AES Distributed Energy, who announced their own solar-plus-storage energy plan for just 11 cents per kWh. However, these are still relatively pricey. The majority of customers in the mainland United States pay even less, illustrating how far costs have been driven down.

In May 2017, Tucson Electric Power in Arizona announced it signed a 20-year Power Purchase Agreement with NextEra Energy for a 100 MW output solar plant with 30 MW/120 MWh of energy storage for only 4.5 cents per kWh. After almost making it a whole year as the most affordable solar-plus-storage project in the world, it was outdone. In January of 2018, Xcel Energy listed a median bid price for solar-plus-storage project at just 3.6 cents per kWh, solidifying solar-plus-storage’s title as an energy titan. This is in sharp contrast to the electricity generated from burning fossil fuels, which ranges anywhere from 5 to 17 cents per KWh. At this pace, renewable energy will be consistently cheaper than fossil fuels by 2020, according to Forbes magazine.

This article is based off of Navigant Research’s Q3 2018 report: North American Energy Storage Copper Content Analysis, which was commissioned by the Copper Development Association. To view the report, visit copper.org.

Find Us on Socials